Who are liable for EPF SOCSO and EISs Contribution. Wages Liable for EPF Contribution.

Decoded What Is Provident Fund And When Can You Withdraw Money From It Business Standard News

Among the payments that are liable for EPF contribution.

. Retrenchment temporary lay-off or termination benefits. The payments below are not considered wages by the EPF and are not subject to EPF deduction. 5 interest per year for delays of up to 2 months.

Payments that are liable for EPF contributions According to Section 431 of the EPF Act 1991 every employee and every employer must make monthly contributions to the EPF. 15 interest per year for a delay of 4-6 months. Payment for un-utilised annual or medical leave.

Download a copy of the Form C from the wwwepflk and inquire following numbers to obtain reference nos. What constitutes as wages under the EPF Act. What constitutes as wages under the EPF Act.

This interest rate is calculated every month and then transferred to the Employee Provident Fund accounts every year on 31st March. Also the credited amount to a members account cannot be attached against any liability as the Provident Fund enjoys. Employee Pension Scheme EPS 833.

Contribution by an employee Contribution towards EPF is deducted from the employees salary. Now you will pay tax of 45K 30 tax bracket and get only Rs 105 lacs in your bank account. Wages is defined under the EPF Act to mean all remuneration in money due to an employee under his contract of service or apprenticeship and includes any bonus.

Commonly known as Kumpulan Wang Simpanan Pekerja KWSP the Employees Provident Fund EPF is a social security institution in Malaysia. Payment Liable for EPF Contribution. Payment for unutilised annual or medical leave.

The excess Rs 4 lacs Rs 25 lacs Rs 15 lacs will be paid as salary and will be taxed. Employee As monthly remuneration including all liable payments as mentioned above stands at RM6250. Penalty charge for late payment under Section 14B - In case of delay or failure of challan payment the following penalties are charged -.

It is important to know this important rule which gives you a right to claim your EPFO from the company you are working with. Your mandatory contribution is calculated based on your monthly salary as an employee in accordance with the Contribution Rate Third Schedule. Your employer will have to pay contributions towards EPFO accounts in priority over his other debts.

Payment Liable for EPF Contribution. Subject to the provisions of section 52 every employee and every employer of a person who is an employee within the meaning of this Act shall be liable to pay monthly contributions on the amount of wages at the rate respectively set out in the Third Schedule. ETF Board has introduced on-line payment scheme since it is the most convenient and quick payment system.

Any gratuity payable on discharge or retirement of the employee. A bench of Justices Ajay Rastogi and Abhay S Oka said Employees Provident Fund Miscellaneous Provisions Act is legislation for providing social security to the employees. In HReasily any pay items labelled as Bonus will not reduce the employer contribution to reduce to 12 in the event the bonus bumps employees monthly wages above the RM5000 threshold.

10 interest per year for 2-4 months delay. The payments below are not considered wages and are not included in the calculations for monthly deductions. The interest earned on EPF is exempted from tax.

Any contribution payable by the employer towards any pension or provident fund. Thus notwithstanding the labels that used to describe the payments the employer was still liable to make contributions to the EPF. Employee Provident Fund Interest Rate.

Payments which are not liable for EPF contribution are-. In general all payments which are meant to be wages are accountable in your monthly contribution amount calculation. Any other remuneration or payment as may be exempted by the Minister.

EPF Contributions at Malaysiapdf. In general all payments which are meant to be wages are accountable in your monthly EPF contribution amount calculation. Thus notwithstanding the labels that used to describe the payments the employer was still liable to make contributions to the EPF.

EPF contributions at PDF copy. Based on the Contribution Rate within the Third Schedule the employers contribution should be RM756 12 while the employees contribution stands at RM567 9. Contribution by an employer -The contribution made by the employer is 12 of the basic salary of the employee.

How to pay EPF contributions through Peoples Bank if not received a pre-printed Form C. The current interest rate for EPF for the FY 2021-22 is 810 pa. Among the payments that are exempted from EPF contribution include.

This includes bonus commission or any allowance which an employer is required to pay irrespective of whether such a payment is paid under a contract of service or apprenticeship or others. Full time Malaysian employees 48 hours per week part-time employees with working hours between 30 to 70 with the company directors for Sdn. All remuneration in money due to an employee under hisher contract of service or apprenticeship whether it was agreed to be paid monthly weekly daily or otherwise.

Any sum paid to cover expenses incurred by the employee in. Who is responsible for remitting EPF contributions to EPF Department. 25 interest per year for delays of more than 6 months.

Payments Exempted From EPF Contribution. As for the amount that needs to be contributed this can be calculated based on the employees wages and the Third Schedule of the Act not by exact percentages. Any travelling allowance or the value of any travelling concession.

Access to internet banking makes EPF contribution payments much easier now. An employer is under an obligation to pay the damages for delay in payment of the contribution of Employees Provident Fund of an employee the Supreme Court said on Wednesday. Monthly contributions are made up of the employees and employers share which is paid by the employer through various methods available to them.

Employees Provident Fund EPF 367. Formed in 1951 pursuant to Employees Provident Fund Ordinance 1951 the EPF went through several iterations to become the EPF Act 1991 Act 452 as we know it today. Wages is defined under the EPF Act to mean all remuneration in money due to an employee under his contract of service or apprenticeship and includes any bonus.

Retrenchment lay-off or termination benefits. Earlier this 15 lacs would have gone to your EPF account and earn tax-free income. However this 12 is further subdivided into.

Through Internet Employers are able to pay ContributionsSurcharges to the ETF Board and upload contribution details of the members 24 hours of any day irrespectiveof a bank holiday from their own office or from any remote location. Gratuity payment to employee payable at the end of a service period or upon voluntary resignation Gifts includes Cash Payments for holidays like Hari Raya Christmas etc. This brings the total monthly EPF contribution to RM1323.

Payment Liable for EPF Contribution.

Pf Online Payment Process To Make Epf Online Payment

Pf Withdrawal Everything You Need To Know About Epf Withdrawal

Employer Must Pay Damages For Delay In Payment Of Epf Contribution Rules Sc Mint

Employer Must Pay Damages For Delay In Payment Of Epf Contribution Rules Sc Mint

How To Calculate Provident Fund Online Calculator Government Employment

Explained All About How Your Epf Contributions Above Rs 2 5 Lakh Would Be Taxed

A Complete Guide On Process For Epf Withdrawal Online Claim Ebizfiling

How Epf Employees Provident Fund Interest Is Calculated

Pf Relief May Be Taxing In The Long Term Mint

Interest On Epf Contribution Above Rs 2 5 Lakh To Be Taxable What It Means For You Businesstoday

Check Epf Balance In 4 Easy Steps Online Infographic Balance Sms

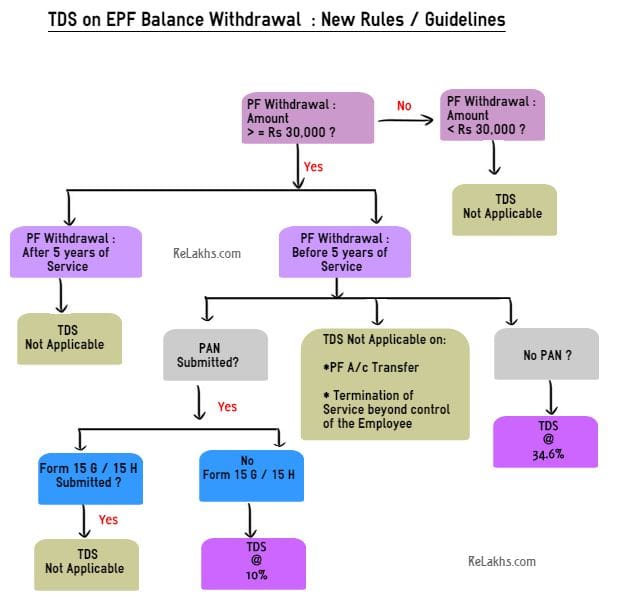

Epf Withdrawals New Rules Provisions Related To Tds

Epf Member Passbook For Tax Calculation Passbook Flow Chart Hobbies To Try

No Penalty On Employers For Delay In Provident Fund Contributions Decides Epfo The Financial Express

Tax On Epf Withdrawal Rule Flow Chart Tax Deductions Tax

Epf All About Employees Provident Fund Scheme

Check Epf Balance In 4 Easy Steps Online Infographic Balance Sms

Pf Withdrawal Everything You Need To Know About Epf Withdrawal